Guggenheim BulletShares 2025 Corporate Bond ETF (BSCP)

Performance & Return

| Period | Investment | Benchmark | Alpha |

| 1 Day | 0.00% | 0.00% | 0.00% |

| 3 Months | -0.24% | -3.35% | 3.10% |

| Year-to-Date | -0.34% | -5.08% | 4.74% |

| 1 Year | 0.00% | 0.00% | 0.00% |

Risk, Fees & Styles

(as of 9/30/2020)RISK PROFILE Help

Fund's Risk

10%

(moderate)

POTENTIAL GAIN & LOSS Help

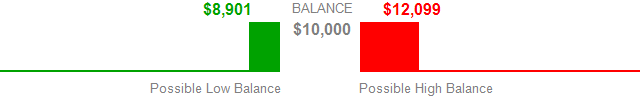

The fund's risk of 10% means its value in a year is likely to fluctuate within the following ranges:

FEES Help

- 0.00%

Typical fees paid for an investment of $10,000 over 10 years:

Total fees paid

$0

Real cost (fees + lost compounding)

$0

FUND STYLE ANALYSIS Help

Style weight explainability

(of prior year return)

69%

Return in excess of styles

(over past year)

0.77%