Guggenheim S&P 500 Pure Value ETF (RPV)

Performance & Return

| Period | Investment | Benchmark | Alpha |

| 1 Day | 0.00% | 0.00% | 0.00% |

| 3 Months | 6.54% | 5.37% | 1.17% |

| Year-to-Date | 4.04% | 3.16% | 0.88% |

| 1 Year | 0.00% | 0.00% | 0.00% |

Risk, Fees & Styles

(as of 9/30/2020)RISK PROFILE Help

Fund's Risk

46%

(very high)

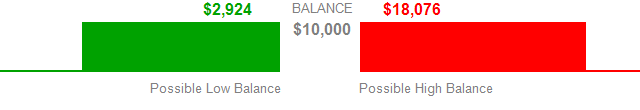

POTENTIAL GAIN & LOSS Help

The fund's risk of 46% means its value in a year is likely to fluctuate within the following ranges:

FEES Help

- 0.35%

Typical fees paid for an investment of $10,000 over 10 years:

Total fees paid

$454

Real cost (fees + lost compounding)

$561

FUND STYLE ANALYSIS Help

Style weight explainability

(of prior year return)

97%

Return in excess of styles

(over past year)

-6.42%